Managing expenses

A Guide to VAT in the Isle of Man

Who pays VAT?

The purpose of Value Added Tax (VAT) is to raise revenue through taxing the end consumer based on the additional value added in the creation of a good or service.

What is Isle of Man's agreement with UK on VAT?

The Isle of Man is part of the UK for VAT. The Isle of Man and UK have a revenue sharing agreement where VAT is charged in both jurisdictions, the receipts pooled together and the tax shared under the terms of the agreement. Click here to view more information and for a detailed explanation of the United Kingdom & Isle of Man Indirect Tax Final Expenditure Revenue Sharing Arrangements (FERSA).

Who has to charge VAT?

VAT must be charged on most goods and services sold in the Isle of Man & UK – these are called ‘taxable supplies’. The rate of VAT varies depending on what type of goods & services are being supplied. Please view our detailed guide on VAT in the Isle of Man below.

Do businesses have to pay VAT on raw materials?

VAT is recoverable on costs incurred by VAT-registered businesses in so far as the cost relates to making taxable supplies. The diagram below illustrates how businesses reclaim input VAT. In essence, businesses as a tax collector on behalf of the government.

Are there any schemes available to help process VAT payments?

The VAT flat rate scheme is designed to simplify VAT accounting for small businesses, reducing the amount of paperwork they are required to complete. Flat rate allows businesses to apply a fixed flat rate percentage to gross turnover to arrive at the VAT due.

Download our detailed guide on VAT thresholds, VAT rates and, the VAT flat rate scheme.

Or if you prefer, you can watch a detailed video presentation by Mark Shuttleworth from Isle of Man Customs & Excise about VAT for small businesses.

Further guidance can be obtained from Isle of Man Customs and Excise Business Support Team:

Website: www.gov.im/customs

In person: Custom House, North Quay, Douglas

By telephone: 01624 648130

By Email: customs@gov.im

Download VAT guide

Is Beer Duty part of the VAT agreement?

Alcohol duties are applied to alcoholic products. Alcoholic products include beer, wine, ciders & spirits. The rate of duty varies depending on the alcoholic strength of the product – with the lowest alcohol content (ABV) attracting the lowest rate of duty. Island producers and importers of alcoholic products declare and pay alcohol duty to the Treasury before they are released for consumption to customers.

There are concessions permitted for small producers and draught products which may reduce the amount of duty payable.

The Isle of Man Government has a long standing Agreement with the UK Government to keep all Customs and Excise duties (which includes Alcohol Duty) aligned to the UK law. This includes the rates of these duties. There is an exception in the Agreement which permits a rebate on duty paid in relation to beer consumed in the Island.

Most of the alcoholic products consumed in the Island come from the UK with alcohol duty declared and paid to HMRC by UK producers or UK importers who would also potentially be able to benefit from a rebate.

Beer Duty is shared based on consumption, not origin. As a majority of the revenue is raised in the UK, this would result in any discount applying to UK based businesses also.

The alcohol duty revenue is shared with the UK using FERSA any agreement to provide a rebate would require an adjustment under FERSA.

Managing Energy Usage

Manx Utilities, offer fixed monthly direct debits for non-domestic electricity customers (large non-domestic ‘industrial’ customers must pay monthly as they are billed monthly) in the same way as they do for domestic customers.

If a customer has a specific concern then they should contact the customer services team on 687 687, free phone 0808 1624 115 or via email at enquiries@manxutilities.im and a member of the team can discuss the specific circumstances with the customer.

Business Energy Saving Scheme

The Business Energy Saving Scheme (BESS) offers 100% interest-free unsecured loan to all eligible types of businesses seeking to make their operations more energy efficient and lower their energy costs.

Features

- Financial assistance starting from £1,000 up to £20,000 per project

- Five year payback period

- Fast-track application process for loans under £5,000

- Applicants can also complete a Business Improvement Scheme Environmental Efficiency project

FAQs

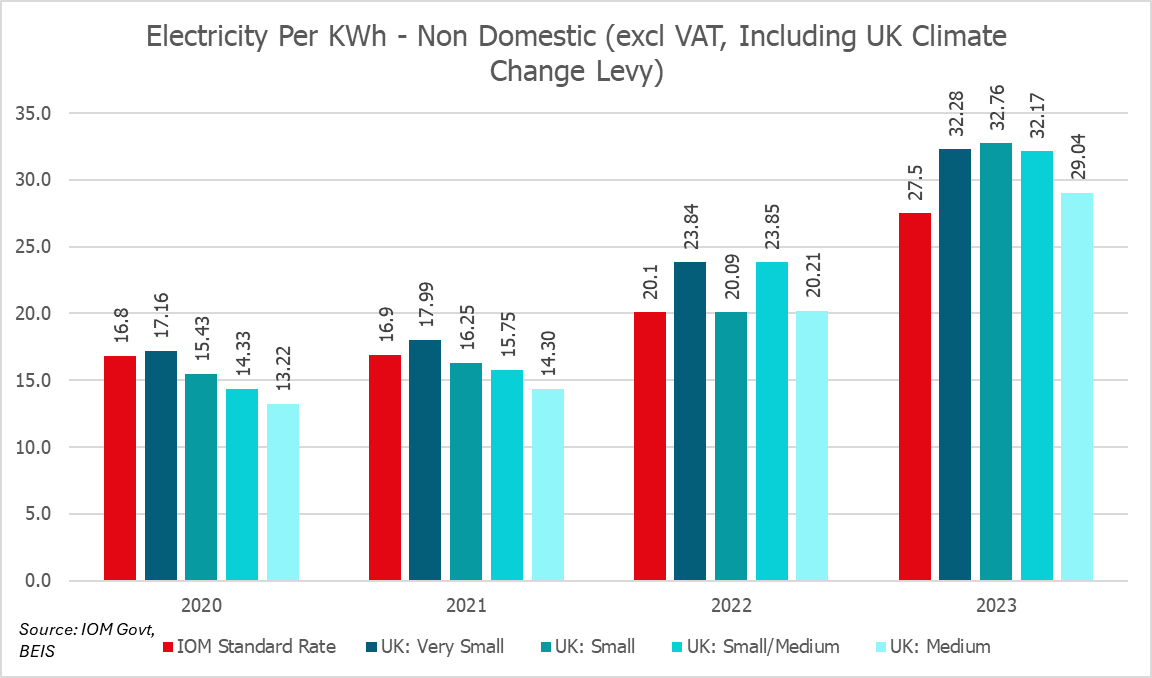

Although the Isle of Man does not have several size classifications for tariffs, our overall standard tariff is lower when compared to the UK for small to medium enterprises.

Data Source:

IOM data comes from Manx Utilities Data collected by the OFT:

Isle of Man Government - Domestic heating comparisons

UK Data comes from Department for Energy Security and Net Zero:

Gas and electricity prices in the non-domestic sector - GOV.UK (www.gov.uk)